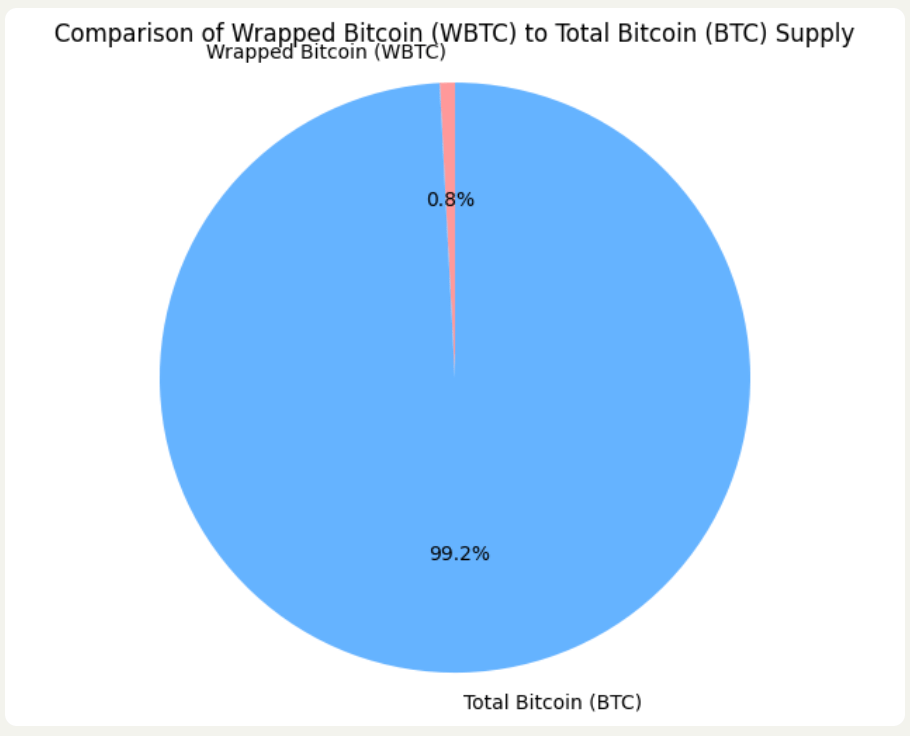

Bitcoin interoperability is quickly becoming one of the hottest topics in crypto, especially in the wake of the Wrapped Bitcoin (WBTC) drama. With only 1% of Bitcoin being wrapped, the entire ecosystem is in its infancy. And what about that 1%?

Well, WBTC dominates the scene, but cracks are beginning to show—leaving the door wide open for new players to step in. The narrative of centralized control, like that of WBTC, now seems shaky.

This article dives into why Bitcoin interoperability is not just a trend but a necessity, and how innovations like those from Persistence One could lead the BTCfi revolution.

The Downfall of WBTC: A Comedy of Centralization?

The concept of wrapping Bitcoin was genius. You get the security and value of BTC with the flexibility of Ethereum’s DeFi ecosystem. But things aren’t always as rosy as they seem.

Wrapped Bitcoin (WBTC) quickly rose to prominence. Things went well until a point when BTC decided to get into a partnership with BitGo. Now this is not a typical social handshake partnership but something serious.

It wasn’t long before people started to notice that this wrapped wonder wasn’t decentralized at all. In fact, it’s heavily centralized, with now custodian (BitGo) holding the actual BTC in a single wallet.

Cue the WBTC drama. As outlined beautifully by Decentralized.co, recent events have highlighted concerns over centralization, transparency, and governance. BitGo essentially became the gatekeeper of all wrapped Bitcoin, which, in the world of decentralization, is kind of like putting the fox in charge of the henhouse.

In a space that prides itself on “trustless” systems, the WBTC model doesn’t quite fit. Sure, it still works, but the mood has shifted. Bitcoin purists are skeptical, DeFi enthusiasts are wary, and the wider crypto community is realizing that WBTC may not be the end-all, be-all solution for Bitcoin in decentralized finance (DeFi). This opens the door for alternatives—and the pie is enormous.

The Pie is Untapped: Time for More Players to Step Up

Only 1% of Bitcoin is wrapped. Yes, that’s right, just a tiny slice of the total Bitcoin supply is currently in DeFi. With WBTC holding the lion’s share, there’s plenty of room for competition. The untapped potential here is mind-blowing. If only 1% of BTC is wrapped and the existing leader (WBTC) is already wobbling, what happens when more players come to the table?

The opportunities are endless. Picture this: an ecosystem where multiple protocols offer different flavors of wrapped Bitcoin, each with unique benefits. Some might focus on pure decentralization, while others may prioritize speed, cross-chain liquidity, or even privacy features. The WBTC downfall is a golden opportunity for innovation, and projects like Persistence One could be just what the crypto doctor ordered.

Enter Persistence One: The Bitcoin Interoperability Hero?

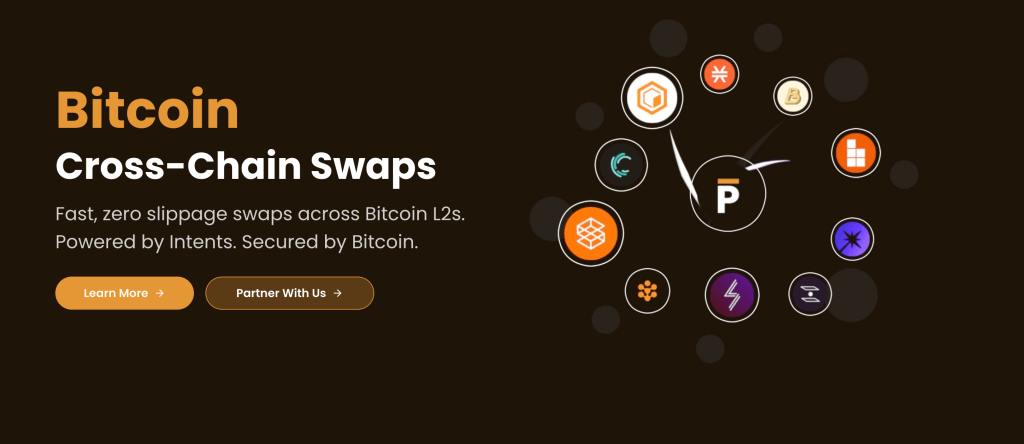

Now, let’s talk about the future. While WBTC may have dominated the early game, the BTCfi race is just heating up. If Bitcoin is to truly enter the decentralized finance world in a meaningful way, we need a new paradigm. This is where Persistence One comes into play.

Persistence One’s focus on interoperability offers a game-changing proposition. Bitcoin can no longer be trapped in siloed ecosystems like Ethereum. To truly unlock its value, BTC must move freely across multiple chains and protocols. It’s about making Bitcoin as versatile and agile as Ethereum—but with the massive value and security that only Bitcoin can provide.

In simple terms, Persistence One is building the infrastructure to make Bitcoin interoperable across different chains. Think of it as giving Bitcoin a universal passport, allowing it to participate in DeFi, lending, staking, and much more across various blockchains. The potential here is staggering. In a world where only 1% of BTC is wrapped, Bitcoin interoperability is the key to unlocking the other 99%.

Why Interoperability is a Must for BTCfi

Let’s be honest. Bitcoin is great, but in its current state, it’s like that rich uncle who has all the money but doesn’t know how to use a smartphone. Sure, he’s valuable, but what good is that value if it can’t be easily accessed or utilized?

Interoperability is the key. Without it, Bitcoin will remain stuck in its own ecosystem, unable to tap into the DeFi opportunities exploding around it. BTCfi (Bitcoin Finance) is more than just wrapping BTC for Ethereum. It’s about making Bitcoin compatible with other chains, like Persistence One’s platform. It’s about making Bitcoin liquid, usable, and smart.

And honestly, why should Ethereum have all the fun? The future is cross-chain, and the biggest asset in crypto needs to be able to move freely. Bitcoin can’t afford to be the awkward guy in the corner while Ethereum parties with DeFi, NFTs, and DAOs. It’s time for Bitcoin to step into the limelight.

Wrapping It Up: The Future of Bitcoin in DeFi

The WBTC drama is just the beginning. As Decentralized.co aptly points out, the centralized nature of WBTC has exposed weaknesses in the current model. But with every downfall comes opportunity. The future of BTCfi isn’t just about wrapping BTC; it’s about building the infrastructure for true Bitcoin interoperability.

The pie is massive, and there’s plenty of room for new players. Persistence One is one of the key innovators, enabling Bitcoin to finally join the DeFi party across multiple chains. In this new era of cross-chain finance, Bitcoin will no longer be the outsider—it will be the star.

And with only 1% of BTC wrapped, the race is on. Let’s see who can unwrap Bitcoin’s full potential.