Nearly 15 years ago, an enigmatic pseudonym unveiled the Bitcoin whitepaper, introducing a revolutionary alternative to government-controlled money. What started as an idea soon earned its place as the digital equivalent of gold. And with it, the era of public blockchains was born.

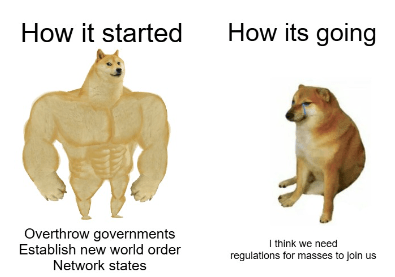

Inspired by the ethos of decentralization, we set out to eliminate the central authority in everything from finance (DeFi) to beyond (Web3). Yet, a decade later, we still find ourselves chasing the dream of achieving ‘mass adoption.’

For dataphiles, crypto has soared from a modest market cap of $6 billion to a staggering $2 trillion in the past decade. Impressive, right? But hold your applause—global stock markets have also grown, leaping from $63 trillion to a whopping $115 trillion in the same period (source).

Yes, despite the colossal size of the equity markets, they’ve outpaced crypto in absolute growth. So are there any faults in our stars? Or is there a solution waiting to be discovered? Let’s dive in and explore these questions today.

- Reasons behind missing the ‘mass adoption’ bus

- How RWA is the holy grail of adoption

- How is E Money network trying to fix it

- How other public blockchains (Solana) can leverage E Money Network to up their game

The Mass Adoption without Masses:

Take it with a pinch of salt but crypto is a classic example of the underdog theory. This explains why Bitcoin gained disproportionate attention, sympathy, or support, even when its odds of winning were slim.

Fast forward, and this once-underdog is now a headline act, offered as a product by the world’s largest wealth management companies. But here’s the catch: if you want to dive into blockchain and execute diverse use cases today, you’ve got to play by the rules of the land.

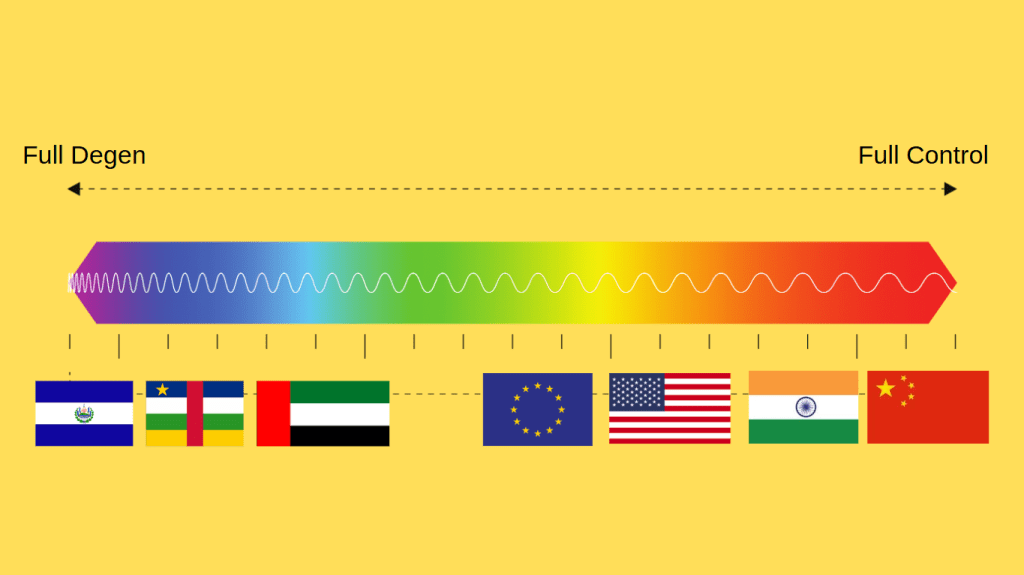

These rules are as tricky as they come, navigating a spectrum that stretches from El Salvador to China.

Certain nations, such as El Salvador, Estonia, Malta, and Switzerland, have established themselves as cryptocurrency hubs by fostering supportive environments to attract blockchain and crypto businesses. Meanwhile, regions like the European Union (EU), Latin America, Asia, and the Middle East are focused on developing comprehensive regulatory frameworks for cryptocurrencies.

The spectrum above reveals a very important trend.

The nations with miniscule impact on global GDP can go all hog on crypto with little to no impact on adoption. Whereas the bigger, stable economies are relying on regulations to proceed further.

tl;dr: Mass adoption has to go through regulatory clarity

Now that we’ve got that out of the way, let’s dig a little deeper. Which jurisdiction out of the developed, meaningful economies have made significant strides in this direction?

As it happens, about a year ago, the EU rolled out MiCA—the Markets in Crypto-Assets bill.

This legislation establishes a comprehensive regulatory approach to crypto assets across all 27 EU member states, facilitating seamless business transactions between countries without the hassle of additional paperwork.

RWA: Reaching Wider Adoption

Seven years in crypto, and I still can’t get over how terrible the nomenclature is. Take something like ‘real world asset’ which feels like you are admitting to be delusional, virtual, echo chamber laden, loner.

Anyway, if you want to understand RWAs, start by grabbing your neighborhood crypto bro and asking, “What is blockchain even used for?” Brace yourself; they’ll probably throw around words like revolution, freedom, or godspeed. Now, do yourself a favor—forget whatever they just said and listen to me instead.

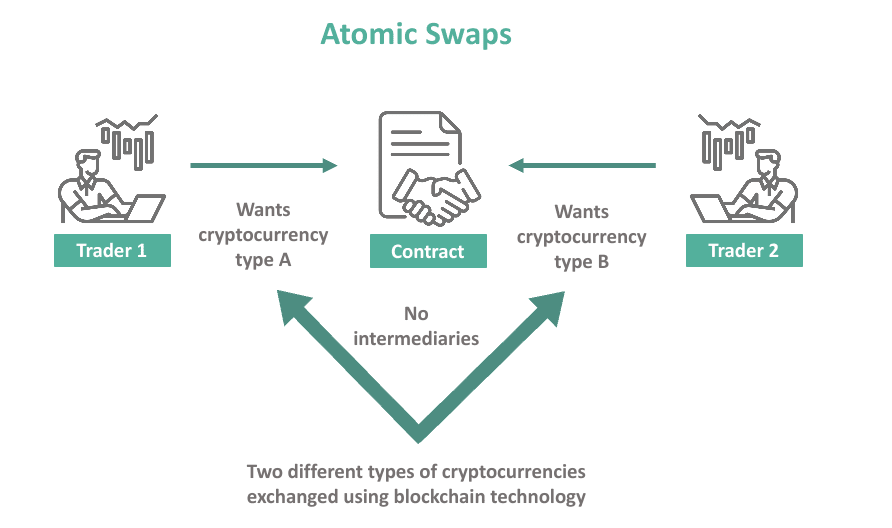

Fundamentally, blockchains serve a single, defining purpose: enabling immutable, atomic swaps. Whether it’s your prized NFT, your favorite memecoin, or a legitimate investment, blockchains allow two people to transact without needing to trust each other.

The asset being exchanged could represent anything—a tangible entity like real estate, bonds, or even paintings. That’s what they mean when they talk about RWA: simply a digitally tradable representation of an off-chain asset.

Why did I bring this up, you ask? Well, it’s because if Web2 and Web3 were to tie the knot, this would be their showstopper moment. RWA tokenization would undoubtedly play a pivotal role in this union, especially since most TradFi use cases already revolve around it.

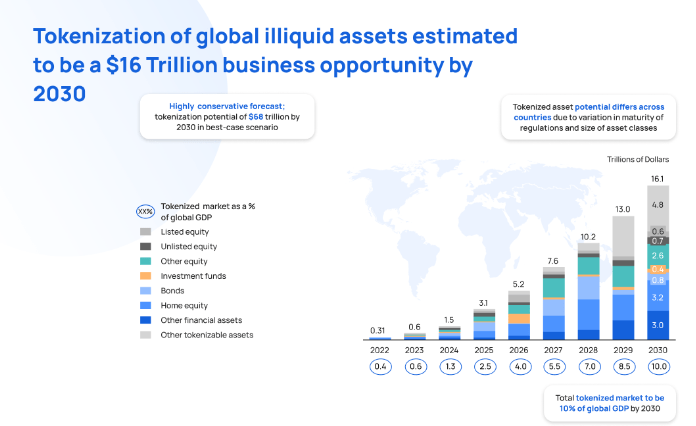

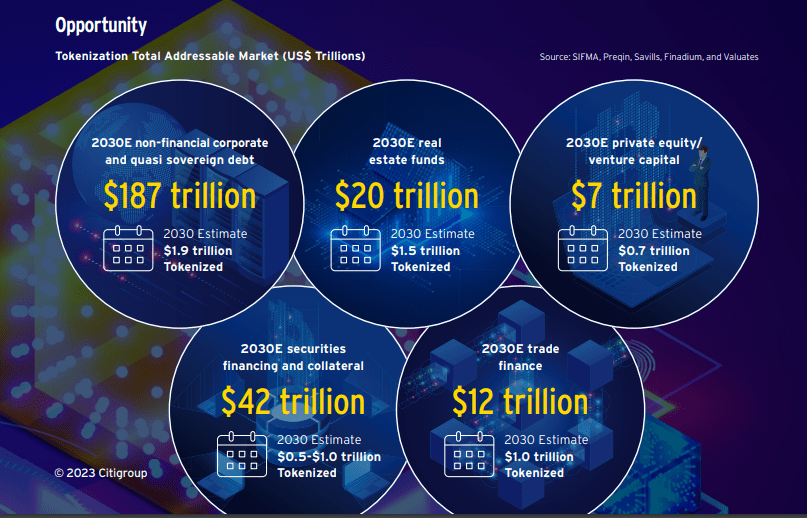

For context, tokenizing illiquid assets could potentially account for a whopping 10% of the global GDP by 2030. Let that sink in.

A Citibank report published in 2023 highlights some giga-opportunities in tokenization.

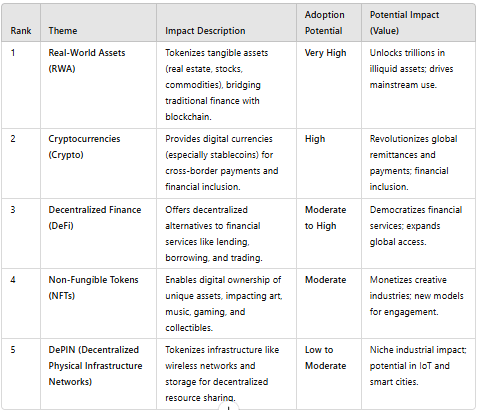

When I fed a bunch of reports to OpenAIs latest thinking model and asked it to rate all Blockchain narratives in the precedence of impact, this is what it came up with:

So analytically and empirically, RWA looks like an area that will explode into mass adoption sooner than later.

But what if we marry regulations with RWAs? Do we finally have the coveted mass adoption? Let us find out.

Enter: E Money Network

Despite the noisy neighborhoods we live in, the total value locked across all crypto protocols sits at around $100 billion. Now, compare that to just one Bank of America, which holds a whopping $2.4 trillion in assets. Ha! Puny.

The vision of the E Money Network is to pave the way for DeFi 2.0, spearheading the ongoing evolution of the decentralized finance ecosystem. It’s a no-brainer that they aim to achieve this vision by focusing on RWAs and compliance—two things we’ve already touched on in previous sections.

E Money Blockchain:

At its core, the E Money Network is a public, permissionless, and regulated blockchain. It has secured licenses across 100+ jurisdictions, including MiCA, Canada, and Dubai.

This makes EMN the preferred choice for both Web2 institutions transitioning on-chain and Web3 players aiming to build in compliance (we’ll dive into that shortly).

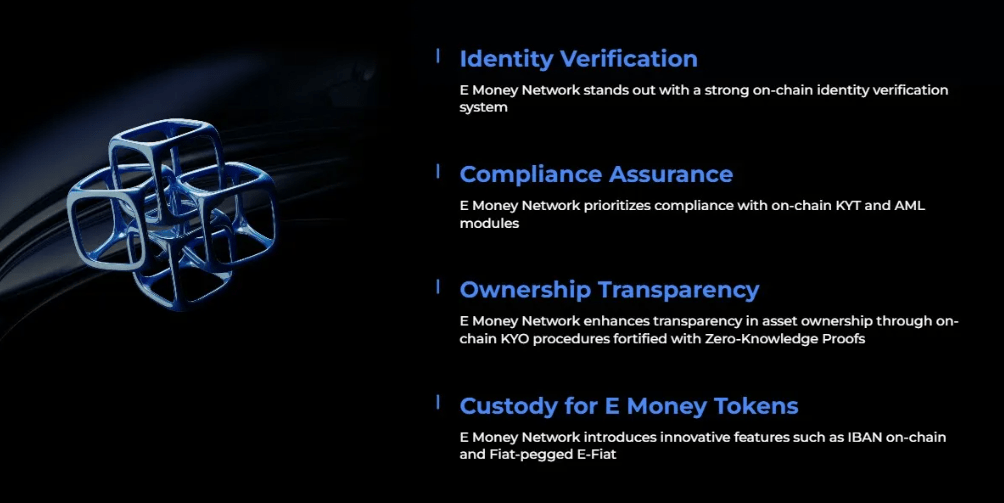

The E Money Network also introduces four modular proofs designed to tackle key challenges in decentralized finance (DeFi) — asset ownership, transaction legitimacy, identity verification, and custody. Here’s what they entail and how they work:

1. Proof of Identity:

Integrates on-chain identity (KYC) verification and Know Your Business (KYB) protocols to build a trust-based ecosystem for participants. Do I really need to spell out how crucial this is when you’re working with governments?

This approach tackles identity-related concerns in a decentralized system, paving the way for institutional adoption and ensuring regulatory compliance.

2. Proof of Transaction (KYT):

Ensuring every transaction aligns with Anti-Money Laundering (AML) standards, KYT plays a pivotal role in combating financial crimes while maintaining operational efficiency. Government agencies monitor the inflow and outflow of funds across borders to safeguard national security, and KYT is a vital part of this process..

This builds trust in the ecosystem by preventing fraudulent activities and facilitating seamless audits.

3. Proof of Ownership (KYO):

This module verifies asset ownership using advanced cryptographic techniques, ensuring robust security while safeguarding sensitive personal data.

It gives E-Money Network an edge over existing web2 systems. Why? Because provable digital ownership is only possible through Blockchains.

The result? Fewer disputes over asset claims and enhanced security for both users and institutions.

4. Proof of Custody:

This innovation is a cornerstone of the E-Money Wallet ecosystem, delivering secure, transparent, and compliant storage and management for both digital assets and fiat-pegged currencies. It tackles one of the biggest challenges in blockchain and decentralized finance (DeFi): safeguarding assets without compromising seamless usability for everyday financial activities

Proof of custody provides a secure foundation for asset custody, enabling seamless integration of traditional and blockchain finance.

E Money Wallet:

The E Money Wallet is a sophisticated, compliance-driven Web3 wallet designed to bridge the gap between traditional financial systems and decentralized blockchain networks.

While building a compliant blockchain is essential, it’s only part of the solution. Without a secure and compliant wallet, the entire ecosystem remains exposed to vulnerabilities. Take the Ronin Network incident of 2022, for instance—a $600 million hack occurred because of a compromised wallet validator, highlighting the critical risks tied to wallet-related breaches.

This highlights how even compliant blockchains can falter when wallets lack robust security, proper private key management, and integration safeguards.

For instance, traditional off-ramping methods often rely on multiple intermediaries, each adding potential points of failure and complicating compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

The E Money Network simplifies this process by embedding International Bank Account Numbers (IBANs) directly into its blockchain infrastructure. This innovation allows users to seamlessly swap between fiat and cryptocurrencies within the E Money Wallet, cutting out the need for external on-and-off ramping platforms entirely.

Marrying Solana and E Money Network:

Now that we understand what E Money Network is upto, it is time to figure out WIIFM. A web3 brain can’t quite fathom the importance of regulations. But the entire ecosystem is bound to benefit from this.

In this section, I am going to highlight these benefits along with the projects in Solana ecosystem that stand to gain big because of EMN.

1. Plug and Play:

Let us start with a no brainer. Simply integrating E-Money wallet for compliance could be a game changer for Solana projects like Serum, Raydium and Phantom.

It is evident that compliance is a key barrier for institutional investors. By removing this barrier, these platforms become more attractive. Historically, platforms that have adopted strong compliance measures have historically seen significant growth in user adoption and capital inflow.

Attracting Institutional Investors: By integrating E-Money’s compliance features, these platforms can attract institutional investors who manage large sums of capital but require regulatory compliance. Institutional participation could increase TVL by an estimated 20-30%, based on industry trends where compliance attracts institutional funds (e.g., the influx of institutional capital into compliant platforms like Coinbase).

User Base Expansion: Enhanced compliance can make platforms more accessible in jurisdictions with strict regulatory requirements, potentially increasing the user base by 10-15%.

Increased Trading Volumes: With more users and institutional participation, trading volumes could see a proportional increase, potentially boosting daily volumes by 25%.

In fact, there is a huge merit in building something grounds up that is compliant. With crypto under institutional radar (ETFs et all), this opportunity could enable vertical DeFi integrations with them.

2. Cross Chain Compliance:

By integrating E-Money’s compliant chain bridge contracts, protocols like Wormhole could see an increase in cross-chain asset transfers by 15-25%. This estimate is based on the assumption that compliance attracts users who were previously hesitant due to regulatory concerns.

Institutions require compliance across all platforms they interact with. By offering compliant cross-chain services, these projects could attract institutional users, potentially increasing the total volume by an additional $500 million to $1 billion monthly.

As DeFi grows, the demand for secure and compliant cross-chain transactions increases. This also ensures a constant influx of users. Offering compliant cross-chain services differentiates these projects from competitors, potentially capturing market share from non-compliant platforms.

3. Access to newer geographies:

E-Money’s compliance infrastructure allows entry into regions with strict regulatory environments (e.g., Europe). These markets represent a substantial user base that is currently underexploited due to compliance barriers. Given that Europe accounts for roughly 15% of global internet users, targeting these regions could realistically result in a 10-20% user increase.

This is in direct correlation with user trust, which directly impacts user adoption rates. Historical data from fintech companies show that adopting compliance measures can boost user growth by up to 25%. Applying a conservative estimate, a 10-20% increase is reasonable.

Quality of user is also a function of regulations. Users in regulated markets often have higher purchasing power. By accessing these markets, average revenue per user (ARPU) could increase, contributing to overall revenue growth of 15-25%. This estimate is based on economic data showing higher disposable incomes in developed markets.

4. Newer Financial Products

No. We are not talking about the likes of $LUNA. But imagine if we had regulatory clarity during that eventful night, things might have been different.

Talking of stablecoins and interest, E-Money’s interest-bearing stablecoins meet a growing demand for yield-generating assets. Given the current low-interest environment, offering these assets could attract significant capital.

A 20-30% increase in TVL for lending protocols is consistent with historical capital inflows when new yield products are introduced.

Note that existing protocols could serve this demand but adding a layer of regulations simply boosts the confidence and hence the user base.

Compliant derivatives and complex financial instruments attract institutional and high-net-worth investors. These investors can contribute substantial volumes; a 25% increase in trading volumes for derivatives platforms like Drift Protocol aligns with increases seen when similar products are launched.

New financial products can create network effects, where the addition of each new user increases the value of the service for others. This can accelerate growth beyond linear rates, justifying the higher percentage increases.

5. Cross Border Payments:

Crypto bros get hard when someone talks about this usecase. So I am gonna add some spice to it.

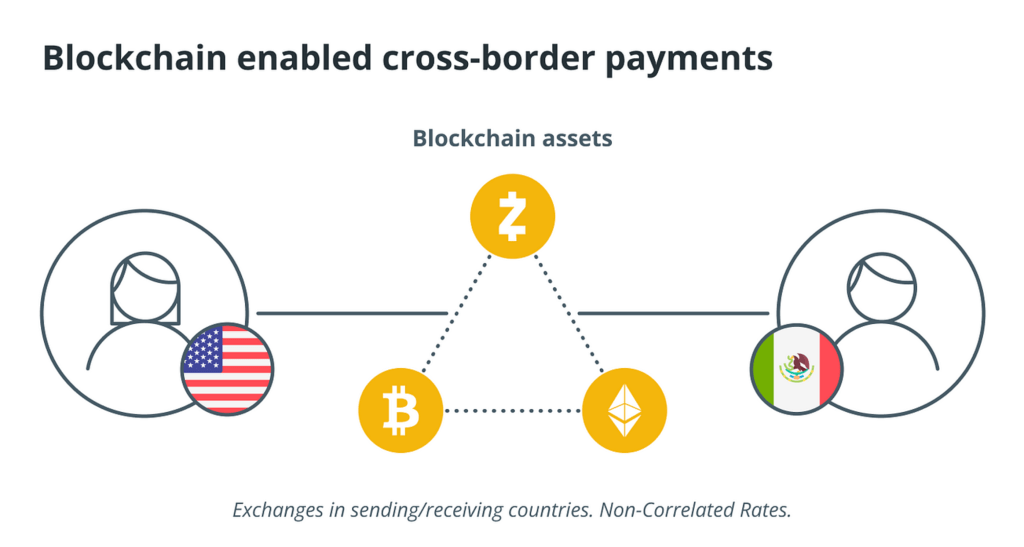

Cross border payments are expected to reach $930 billion by 2026. And. your TradFi remittance services are often slow and expensive, with fees averaging around 7% per transaction.

On the other end of the spectrum we have Paypal experimenting with PYUSD on Solana.

E Money Network can attack this monopoly by allowing other stablecoin players to bring in compliance features like KYC and AML.

Since EMN already supports multiple currencies and offers fast, low-cost transactions Integrating E-Money with Solana’s high-speed network can enhance efficiency.

6. Going Mobile:

Crypto industry entered the market with a narrative of banking the 1.7 billion unbanked citizens in the world. And then it remained restricted to desktops without ever focusing on mobile for the longest time.

Since this is changing right now, E-Money’s mobile wallet technology can be leveraged to reach this user base. With upcoming IBAN integration, this can facilitate a bunch of use cases for a lot of dApps on Solana.

Conclusion:

Crypto’s journey from an underdog to a budding global phenomenon is a classic tale of ambition tempered by reality. The promise of decentralization is no longer just a tech experiment—it’s a movement that now grapples with regulatory hurdles, a hesitating public, and the delicate dance between innovation and compliance.

E Money Network stands as a bridge between the untamed world of Web3 and the structured systems of traditional finance, showcasing that maybe, just maybe, mass adoption doesn’t need to sacrifice its decentralized soul to gain global traction.

But will this formula work? Or will crypto remain the rebellious underdog, forever searching for its big break? Only time—and perhaps some more regulation—will tell.